Global escalation of the U.S. crisis

The U.S., like China, has a huge logistical problem associated with a container shortage that affects the entire supply chain, disrupting trade on a global scale. This problem has arisen due to a cascade of unforeseen events that have been dragging on since the beginning of the pandemic.

Because of sanctions against Russia, huge energy problems have been added, with prices hitting their historic levels or close to it. To contain the discontent and control the situation, it was decided to release the largest strategic oil reserves in the last 50 years, namely 180 million barrels with a total stock of 570 million barrels. This would reduce America's reserves by a third, which is already considered a very dangerous mark for the country's security.

The bottom line at the moment is that oil is down slightly and gasoline is almost at highs.

Crude oil reserve

Jet kerosene prices in New York hit record $320 a barrel

Los Angeles, USA. The average price for gasoline and diesel is $6 or more per gallon.

The shortage of ultra-low-sulfur diesel fuel in New York Harbor is reaching biblical proportions, Bloomberg columnist Javier Bias.

The Federal Reserve of America, represented by Psaki, is beginning to recognize that inflation is now something it hasn't seen in over 40 years and it will continue to rise.

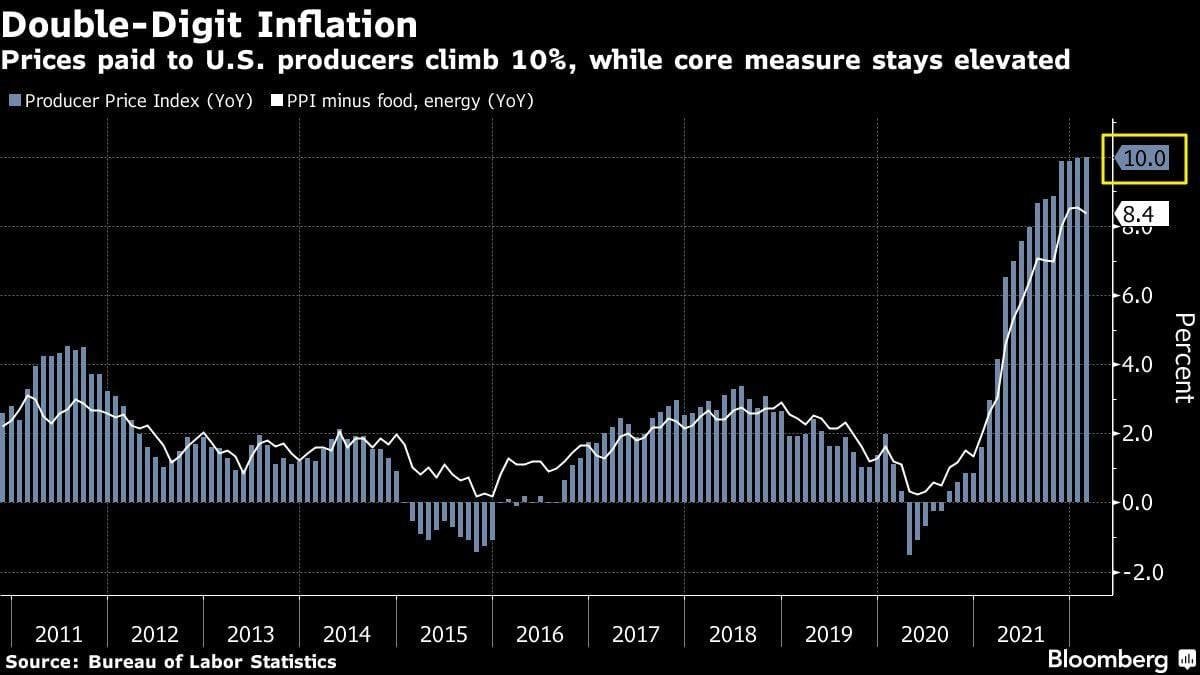

In March, consumer prices were 8.5% higher than a year earlier, the fastest annual increase since 1981. Of course, the current political events involving Russia are being blamed for the huge inflation in the U.S., not without that, but it is definitely not the cause of the early numbers.

U.S. inflation is officially up to 8.5%, but in reality is 3-4 times higher. Given that U.S. government bond yields are now at 1-2.7%, holders lose 6-7% for the year.

U.S. inflation reaches double digits

The U.S. economy is approaching a recession that could begin as early as the fourth quarter of 2022. This is indicated by the IHS monthly GDP index, which shows that U.S. GDP is down from its October 2021 high. Simply put, the U.S. economy is contracting, not growing.

Likewise, a growing number of Wall Street experts are now predicting a possible economic downturn, with the alarm growing louder after the widely watched yield curve flipped and pointed to an impending recession.

Deutsche Bank became the first major Wall Street bank to predict a recession next year, albeit a "moderate" one, thanks to a combination of rising inflation and rising interest rates.

The firm's economists predict that the U.S. economy will take "a serious hit from additional Federal Reserve tightening by late next year and early 2024," and predict "two negative quarters of growth and a U.S. unemployment rate of more than 1.5%."

That's all for now with America, if you are still enthusiastic about the economic situation, I suggest you wait for the next part of this article, which will deal with Europe.

Keep your nose in the wind Friends and may fortune always be with you ;)

Always yours, C.J.